Energy price cap to rise by 6.4%

Newsflash: The energy price cap on bills across Great Britain will rise by 6.4% in April, regulator Ofgem has announced.

This will lift the average annual cost of electricity and gas for a typical household to £1,849 per year, up from £1,738.

This is the third consecutive hike in the cap on gas and electricity charges, and a little higher than analysts had expected.

Here are the details, just released by Ofgem:

[Reminder: the cap limits the amount which a supplier can charge for a unit of electricity or gas].

Key events

Tesla sales almost halve across Europe

Sales of Tesla cars across Europe almost halved in January, new data shows, perhaps a sign of a consumer backlash against Elon Musk.

Just 9,945 Teslas were sold across the European Union, the UK and the EFTA region last month, the European Automobile Manufacturers’ Association (ACEA) has reported,.

That’s a 45% plunge compared with the 18,161 Teslas sold in January 2024.

Despite the slump in demand for Teslas, sales of new battery-electric cars grew by 34% to 124,341 units, capturing a 15% market share.

The overall market shrank by 2.1%. Many of the EU’s major markets saw declines, with France (-6.2%), Italy (-5.8%), and Germany (-2.8%). Spain conversely recorded a 5.3% increase.

There have been signs in recent weeks that Musk’s backing of Donald Trump, and his interference in other country’s politics, may be hurting Tesla, one of the companies he runs.

At the start of January, the French president, Emmanuel Macron, accused the world’s richest man of intervening directly in the continent’s democratic processes.

Last month, protesters gathered outside Tesla dealerships across the US in response to Musk’s efforts to shred government spending through the ‘department of government efficency’ (DOGE).

Musk’s move to the right also saw him back Germany’s far-right Alternative für Deutschland (AfD) party in January, ahead of last weekend’s election.

He also claimed that UK prime minister Sir Keir Starmer was “complicit in the rape of Britain”, in a row over grooming gangs.

The surprise exit of Hein Schumacher will not go down well with investors, explains Chris Beckett, head of equity research at Quilter Cheviot:

“Losing a chief executive after 18 months is never a good thing. For Unilever, especially during a strategy turnaround, it does not suggest things were going well behind the scenes or the business was firing on all cylinders. The last set of results suggested that turnaround had stalled somewhat, with weak guidance and sales growth only likely to improve as the company passes on higher commodity costs.

“Evidence of quick operational improvements are needed when you are embarking on a new strategy, and with new management. The change at the top of Unilever will not see a change in that strategy, which is positive, and guidance has been reiterated. However, the new CEO, current chief financial officer Fernando Fernandez, will have been pivotal in agreeing and implementing that strategy and ultimately is the best the company could do for now. He is well liked and respected and is unlikely to rock the boat, but clearly, as recent results show, work still needs to be done to bring back that momentum.

“Unilever has a long way to go on its road to recovery. The share price offers a bit of headroom to do that, but events such as this will not go down well with investors. Results will be watched even more closely now to ensure there are no signs of cracks within that turnaround strategy.”

Here’s our news story about the rise in the energy price cap:

The FT are reporting that Unilever’s board decided to oust CEO Hein Schumacher at a board meeting yesterday, having decided that finance director Fernando Fernandez was “better suited” to execute the company’s turnaround plan.

Shares in Unilever have dropped 2% at the start of trading in London, as investors react to the surprise departure of CEO Hein Schumacher announced this morning.

Chris Venables, director of politics at Green Alliance, says:

“Energy bills are once again being pushed up because of the UK’s exposure to the global price of gas. The only way to lower energy costs for people is to insulate leaky homes and rapidly scale up homegrown renewables.

We urge the government to ensure its Warm Homes Plan and the upcoming spending review properly allocate funding to these measures. It must ignore the siren calls of denial and delay.”

Consumer champion Martin Lewis is urging households to fix their energy bills now, to avoid the increase in bills in April.

He explains that the cheapest fixed deals available on the market are around 4% cheaper than the current price cap – even before the rise 6.4% announced this morning.

Posting on X, Lewis explains:

HOW TO KNOW IF YOU’RE ON A CAPPED TARIFF

If you’re not on a fix or special deal you are likely on the Cap. It applies to firms standard default consumer tariffs, often called ‘Standard Variable’ or ‘Flexible’ tariffs. If you don’t know assume you, like two third of homes probably are.

THE PRICE CAP IS A PANTS CAP GET OFF IT IF YOU CAN – FIX NOW IF YOU HAVEN’T ALREADY

The cheapest year-long standalone fixes right now are about 4% LESS than the current Cap, never mind once it rises in April, so if you get a good fix now you lock in at a cheaper rate for a year, get price certainty, save instantly and save relatively more once we get to April.

Speaking on Radio 4’s Today programme now, Lewis says he’s hearing that “some good tariffs” are being launched this morning – so consumers should wait until lunchtime for making comparisons.

Money Advice Trust, the charity that runs National Debtline, reports that energy arrears are now the second most common debt they help people with, behind only credit cards.

April’s jump in the price cap will probably make this worse.

Steve Vaid, chief executive at the Money Advice Trust, says:

“This latest price rise will only add to the challenges many people face in keeping up with their bills.

“Ofgem must press ahead with their plans for a Help to Repay scheme, to bring energy debt down, while the Government must urgently bring in targeted bill support through an energy social tariff.

“Anyone struggling with their energy bills, or worried about their finances, should contact a free debt advice charity, like National Debtline.”

Charities call for more help with energy bills

Several UK charities are warning that this morning’s rise in the energy price cap (which covers England, Wales and Scotland) will hurt struggling householdss

The Centre for Ageing Better is concerned that millions of older people already struggling on low incomes will be put into even greater difficulty with increasing energy costs, having already lost their winter fuel payments last year.

Millie Brown, Senior Evidence Manager for Homes at the Centre for Ageing Better, says:

“It is so dispiriting to learn that bill payers must brace for another substantial increase to energy prices from April. For those living on the breadline, desperately struggling to meet the basic costs of everyday living, this will be heartbreaking news.

There are millions of older people who no longer qualify for winter fuel payments who live on paltry incomes that do not even cover the basics of a dignified life. They simply will not be able to afford higher energy prices and will cut back usage further, at significant risk to their own health.

If the government, industry regulators and energy providers can’t stop this seemingly inexorable rise in the cost of energy, then we urgently need to see more support offered to help reduce people’s energy usage.

Home improvement services are vital to improving homes for millions of people, we need adequately funded, comprehensive support for people to maintain, repair and adapt their homes across the country.

By acting now to ensure that everyone has the same access to a national network of one-stop shops for home improvement, we can ensure that safe, suitable, and energy-efficient homes are not a privilege but a basic right for all.”

Independent Age chief executive, Joanna Elson CBE, is urging the government to widen elibility for the Winter Fuel Payment, which it means-tested last summer:

“Today’s price cap announcement is more bad news for the older people in poverty that have already been subjected to a brutally long and cold winter. We now know that energy prices will rise again by 6%, from an average of £1,738 to £1,849. People in later life on low fixed incomes have stretched their budgets to breaking point during the colder months, and many tell us they don’t have enough money to turn the heating on full stop. Now, their bills rise yet again to amounts they simply cannot afford.

“History cannot be allowed to repeat itself next winter. The UK Government needs to put in place plans that support older people in financial hardship to turn their heating on. Since the changes to Winter Fuel Payment were made in July, our helpline has seen a massive increase in calls regarding the payment, and many of the people we have spoken to have made drastic cutbacks, such as only living in one room and cutting down on food.

Far too many older people on low incomes don’t receive Pension Credit and are now falling through the cracks – in the short term, the UK Government should urgently review and widen the financial threshold of the Winter Fuel Payment.

Dame Clare Moriarty, chief executive of Citizens Advice, reports that the number of people living in a household in debt to their energy supplier has reached a new high of nearly seven million.

“We’re particularly concerned about households with children, where over one in three struggle to afford bills, rising to more than half of those on low incomes.

“The government can’t let another winter go by without targeted support for those most in need, and there is a way of paying for this. Our recent analysis found energy network companies made billions in excess profits while households have faced soaring bills, and it’s only right this money be used to help fund better targeted bill support and much-needed debt relief.”

Households will be ‘understandably irritated’ at rising bills

Consultancy Cornwall Insight suggests that the energy price may ‘dip slightly’ in July.

But that would only shave a few pounds off average annual bills, rather than being a meaningful drop.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight, explains:

“There is a sense of déjà vu in the energy market as we watch the price cap rise for a third consecutive time, with the volatile international wholesale market once again the main culprit. Households have been promised falls in bills, and many will be understandably irritated with what they may see as a failure of government energy policy. However, the reality is, our gas-led wholesale power market and reliance on international imports limits the impact of what any government policy can have – at least in the short-term – there is only so much you can do when prices are rising across the world.

“That’s not to say the government and the regulator are without options to help lower consumer bills. Ofgem has ongoing consultations looking at the non-wholesale costs included in the cap, and of course the government has levers it can pull from social tariffs to support payments.

We are also seeing initial considerations on structural changes to the cap, with Ofgem’s consultation on a zero standing charge variant announced last week. However, many would argue all of this is merely tinkering with what is – at least for bill payers – a fundamentally broken system.

Unilever CEO Hein Schumacher to step down

Newsflash: Consumer goods maker Unilever has surprised the City by announcing the departure of its CEO, Hein Schumacher.

Schumacher is leaving Unilever, which owns Marmite, Dove and Ben & Jerry’s, having only taken control of the company 19 months ago, in July 2023.

Unilever says he is departing “by mutual agreement” and will leave the company on 31 May 2025.

He is being replaced by Unilever’s chief financial officer, Fernando Fernandez.

Schumacher had been implementing a “growth action plan”, and Unilever’s board indicaate they want Fernandez to accelerate it – a hint that Schumacher wasn’t making changes quickly enough?

Unilever chairman Ian Meakins explains:

“On behalf of the Board, I would like to thank Hein for resetting Unilever’s strategy, for the focus and discipline he has brought to the company and for the solid financial progress delivered during 2024. Hein introduced and led a significant productivity programme and the commencement of the Ice Cream separation, both of which are fully on track.

The Growth Action Plan (GAP) has put Unilever on a path to higher performance and the Board is committed to accelerating its execution. We are grateful for Hein’s leadership, and we wish him the very best for the future.”

Meakins adds that “while the Board is pleased with Unilever’s performance in 2024, there is much further to go to deliver best-in-class results”….

Last year, Unilever announced it would cut 7,500 jobs through a cost-saving programme.

Government to consult on expanding Warm Home Discount

The UK government is considering giving more support to households with their energy bills.

It is proposing expanding the £150 Warm Home Discount scheme, so that nearly three million more families would be eligible

This would mean one in five families in Britain would get help with their bills through these proposals

Announcing a consultation on the idea, energy Secretary Ed Miliband says:

“This Government is determined to do everything we can to protect people from the grip of fossil fuel markets. Expanding the Warm Home Discount can help protect millions of families from rising energy bills, offering support to consumers across the country.

“This is a Government that will always stand up for working people.

“Alongside this, the way to deliver energy security and bring down bills for good is to deliver our mission to make Britain a clean energy superpower- with homegrown clean power that we in Britain control.”

The government is also planning to accelerate a debt relief scheme which it says will help tackle debt and reduce households’ energy costs.

Ofgem CEO blames international gas prices

Jonathan Brearley, CEO of Ofgem, has blamed “volatile” prices in the wholesale energy sector for pushing up the price cap on British energy bills.

Brearley says:

“We know that no price rise is ever welcome, and that the cost of energy remains a huge challenge for many households.

“But our reliance on international gas markets leads to volatile wholesale prices, and continues to drive up bills, which is why it’s more important than ever that we’re driving forward investment in a cleaner, homegrown system.

Fuel charity: Nearly half of adults expect to ration energy in coming months

The jump in the energy bills in April will force more families to ration energy, warns National Energy Action, the fuel poverty charity.

It has released a new poll showing that 49% of adults in Britain expect to ration their energy in the coming months.

The NEA’s chief executive Adam Scorer says:

‘For the third time in a row the price cap is rising. Households already faced sky-high bills as a result of the energy crisis, and today’s announcement will add to the burden on the most vulnerable. We already see the impacts of sustained high bills – total energy debt is at record levels and rising, and people are rationing their heating to dangerous levels and going without essentials.

‘National Energy Action is calling for additional targeted energy bill support through a social tariff or an expanded Warm Home Discount; a help-to-repay scheme to support households out of debt; and for the government’s Warm Homes Plan to provide significant investment to insulate the coldest homes for the poorest households.’

Ofgem lifts price cap – the details

Here’s more details of April’s rise in the energy price cap just announced, from Ofgem.

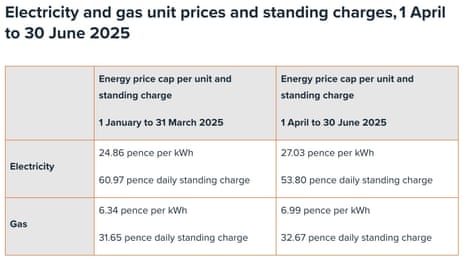

Electricity rates

If you are on a standard variable tariff (default tariff) and pay for your electricity by Direct Debit, you will pay on average 27.03 pence per kilowatt hour (kWh). The daily standing charge is 53.80 pence per day. This is based on the average across England, Scotland and Wales and includes VAT.

Gas rates

If you are on a standard variable tariff (default tariff) and pay for your gas by Direct Debit, you will pay on average 6.99 pence per kilowatt hour (kWh). The daily standing charge is 32.67 pence per day. This is based on the average across England, Scotland and Wales and includes VAT.

Why energy prices have gone up

Rising global wholesale prices for energy are the main reason for the increase. Some people may see a reduction in their standing charges, but this will depend on the region in which they live.

Energy price cap to rise by 6.4%

Newsflash: The energy price cap on bills across Great Britain will rise by 6.4% in April, regulator Ofgem has announced.

This will lift the average annual cost of electricity and gas for a typical household to £1,849 per year, up from £1,738.

This is the third consecutive hike in the cap on gas and electricity charges, and a little higher than analysts had expected.

Here are the details, just released by Ofgem:

[Reminder: the cap limits the amount which a supplier can charge for a unit of electricity or gas].

Jasper Jolly

The expected increase in energy bills in April will help to push the cost of the global energy crisis caused by Russia’s invasion of Ukraine to £3,000 for the average British household by the summer.

The average annual bill in Great Britain under the latest energy price cap is forecast to be about £750 higher than in the pre-invasion winter of 2020-21, a 75% increase, according to calculations by the End Fuel Poverty Coalition, a campaign group.

The cumulative toll of the price increases in the last four years comes to £3,033, the group said.

Introduction: Energy price cap to be set today

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Britain’s cost of living squeeze could tighten today when households if energy bills will rise again this spring.

Ofgem, the energy regulator, is due to announce the latest price cap on the cost of a unit of energy at 7am, and analysts expect the cap to go up, due to recent increases in wholesale gas and electricity prices.

Consultancy Cornwall Insight have crunched the data, and estimate the quarterly cap will rise by 5%. That would increase the typical annual household energy bill about £85 to £1,823 per year – it’s currently £1,738 per year.

The government is concerned about the risk of rising energy bills pushing up inflation.

Last week, a Whitehall source told the Guardian they expected bills in England, Scotland and Wales to increase by about £9 a month over the next three months in another challenge to government plans to tackle the cost of living.

Thie prompted energy secretary Ed Miliband to write an urgent letter to Ofgem, saying the price rise means the energy regulator must move faster to protect consumers.

The energy price cap sets the maximum that a supplier can charge for a unit of energy (there’s no cap on how high a bill can go).

The agenda

-

7am GMT: Energy regulator Ofgem announces UK energy price cap for April-June

-

7am GMT: Final estimate of German GDP for Q4 2024

-

9.45am and 2.30pm GMT: Parliament’s Science, Innovation and Technology Committee holds hearings into social media, misinformation and harmful algorithms.

-

10am GMT: Environment, Food and Rural Affairs Select Committee questions South West Water and Yorkshire Water

Article by:Source: Graeme Wearden