UK pay growth picks up

Good morning, and welcome to our rolling coverage of economics, the financial markets and the world economy.

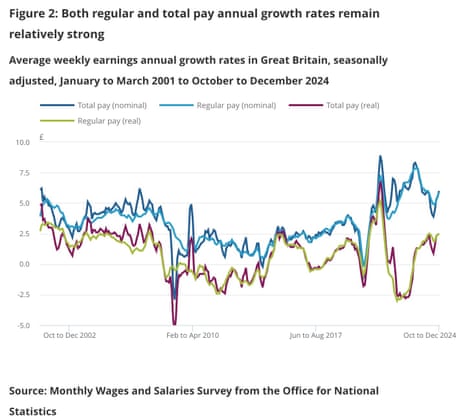

UK pay growth has accelerated at the end of last year, bringing relief to workers and a headache for the Bank of England

The latest employment data, just released, shows that total pay rose by 6% per year in the October-December quarter – up from 4.4% in July-September, and a little faster than City economists expected.

Regular pay (excluding bonuses) rose by 5.9% in the Oct-Dec quarter, down from 4.9% in the previous three months.

These increases mean earnings continued to rise faster than inflation, meaning real wages rose. Adjusted for the CPI inflation rate, both real regular and total pay rose by 3.4% on the year.

That is likely to cause some concerns at the BoE – the Bank cut interest rates earlier this month, but some policymakers remain worried that inflationary pressures are still bubbling.

ONS director of economic statistics Liz McKeown says:

“Growth in pay, excluding bonuses, rose for a third consecutive time, with increases seen in both the private and public sector. After taking account of inflation, real pay growth also increased slightly.

Today’s jobs report also shows that both employment and unemployment rose in the quarter, while the number of people out of the labour market (economically inactive) dipped.

Here’s the details:

-

The UK employment rate for people aged 16 to 64 years was estimated at 74.9% in October to December 2024. This is above estimates of a year ago, and up in the latest quarter.

-

The UK unemployment rate for people aged 16 years and over was estimated at 4.4% in October to December 2024. This is above estimates of a year ago, and up in the latest quarter.

-

The UK economic inactivity rate for people aged 16 to 64 years was estimated at 21.5% in October to December 2024. This is below estimates of a year ago, and down in the latest quarter.

-

The UK Claimant Count for January 2025 increased on the month and is up on the year, at 1.750 million.

The agenda

-

7am GMT: UK labour market force report

-

9.30am GMT: ONS Productivity flash estimate and overview for the UK

-

Morning: Court ruling on Thames Water debt deal

Key events

IoD: Continued decline in job vacancies highlights need for government action

The latest drop in job vacancies (see earlier post) shows that businesses lack confidence to hire new staff, the Institute of Directors warns this morning.

Alex Hall-Chen, Principal Policy Advisor for Employment at the IoD, says:

“The cumulative impact of recent employment reforms, coupled with upcoming increases to employer National Insurance Contributions and the National Living Wage, is significantly weakening the business case for hiring. Our latest data indicates that firms’ headcount expectations remain at historically low levels, comparable to those seen during the early stages of the COVID-19 pandemic in 2020.

“Immediate action is needed to address the mounting pressures on businesses and to restore confidence in the labour market. As the Employment Rights Bill approaches its Report stage, we urge the government to introduce targeted changes that will support employers and stimulate job creation. Our data shows that 41% of business leaders believe that such changes would do most to boost business confidence in 2025.”

This morning’s UK labour market report shows “continued labour market fragility” as 2024 drew to a close, argues Michael Brown, senior research strategist at Pepperstone.

He alaso agrees that the Bank of England will not be pleased to see wages rising so much faster than inflation:

Unemployment, in the three months to December, unexpectedly held steady at 4.4%, marginally below the BoE’s 4.5% forecast. These figures, though, must once again be taken with a pinch of salt, due to the ONS’ ongoing data collection, survey, and quality issues.

Meanwhile, earnings pressures intensified over the same period. Regular pay rose 5.9% YoY at the tail end of last year, the fastest pace since last April, while overall pay (inc. bonuses) rose 6.0% on an annual basis, the fastest pace since November 2023.

Such a pace of earnings growth is, clearly, incompatible with a sustainable return to the Bank of England’s 2% inflation target over the medium term.

Pay is rising rather faster in the private sector than in the public sector.

Today’s labour market report shows that regular pay in the private sector rose by 6.2% in October-December, ahead of the 4.7% increase recorded in the public sector.

Total pay (including bonuses) was 0.1 percentage point higher on both measures.

Payrolls rose in January despite budget ‘hit’

Today’s jobs report should give an insight into how the UK labour market fared after Rachel Reeves’s budget in October.

Many businesses have been griping about the chancellor’s decision to lift employers’ national insurance contributions – which could raise £22bn in extra tax – arguing it will lead to job cuts.

But today’s data estimates that the number of payrolled employees in January increased by 21,000, meaning there were 49,000 more people on company payrolls than a year ago.

That follows a 14,000 drop in December.

Vacancies fall again

Firms are continuing to cut back on vacancies, today’s jobs report shows, as the surge in job opportunities after Covid-19 lockdowns ended fades.

There were an estimated 819,000 vacancies in the UK in November 2024 to January 2025; a decrease of 9,000, or 1.1%, from August to October 2024.

ONS director of economic statistics Liz McKeown said:

“The number of employees on payroll was broadly unchanged in the last three months of the year, continuing a medium-term trend of slowing growth. The number of vacancies also continued to fall in the latest quarter, albeit more slowly, with the total number remaining a little above its pre-pandemic level.

UK pay growth picks up

Good morning, and welcome to our rolling coverage of economics, the financial markets and the world economy.

UK pay growth has accelerated at the end of last year, bringing relief to workers and a headache for the Bank of England

The latest employment data, just released, shows that total pay rose by 6% per year in the October-December quarter – up from 4.4% in July-September, and a little faster than City economists expected.

Regular pay (excluding bonuses) rose by 5.9% in the Oct-Dec quarter, down from 4.9% in the previous three months.

These increases mean earnings continued to rise faster than inflation, meaning real wages rose. Adjusted for the CPI inflation rate, both real regular and total pay rose by 3.4% on the year.

That is likely to cause some concerns at the BoE – the Bank cut interest rates earlier this month, but some policymakers remain worried that inflationary pressures are still bubbling.

ONS director of economic statistics Liz McKeown says:

“Growth in pay, excluding bonuses, rose for a third consecutive time, with increases seen in both the private and public sector. After taking account of inflation, real pay growth also increased slightly.

Today’s jobs report also shows that both employment and unemployment rose in the quarter, while the number of people out of the labour market (economically inactive) dipped.

Here’s the details:

-

The UK employment rate for people aged 16 to 64 years was estimated at 74.9% in October to December 2024. This is above estimates of a year ago, and up in the latest quarter.

-

The UK unemployment rate for people aged 16 years and over was estimated at 4.4% in October to December 2024. This is above estimates of a year ago, and up in the latest quarter.

-

The UK economic inactivity rate for people aged 16 to 64 years was estimated at 21.5% in October to December 2024. This is below estimates of a year ago, and down in the latest quarter.

-

The UK Claimant Count for January 2025 increased on the month and is up on the year, at 1.750 million.

The agenda

-

7am GMT: UK labour market force report

-

9.30am GMT: ONS Productivity flash estimate and overview for the UK

-

Morning: Court ruling on Thames Water debt deal

Article by:Source: Graeme Wearden